Prosper advantage

Prosper has successfully built two critical divisions that drive our competitive advantage in the market;

construction and property management.

Prosper has successfully built two critical divisions that drive our competitive advantage in the market;

property management and construction.

Being able to force appreciation that leads to having multiple options on the exit are two of the main reasons Prosper focuses on value-add opportunities as opposed to building new construction, buying Class A, or stabilizing properties. Investors in stabilized multifamily assets mostly rely on market-driven rent appreciation or cap rate compression to deliver yield. Prosper can force appreciation through its proven process of adding value to properties through renovations and operational efficiency through its property management team. Historically, Prosper has been able to complete 90%+ of the value-add process within the first 12-18 months of acquisition, which would not be possible without an in-house construction management team. This kind of speed allows Prosper to drive yield through execution rather than relying on market forces.

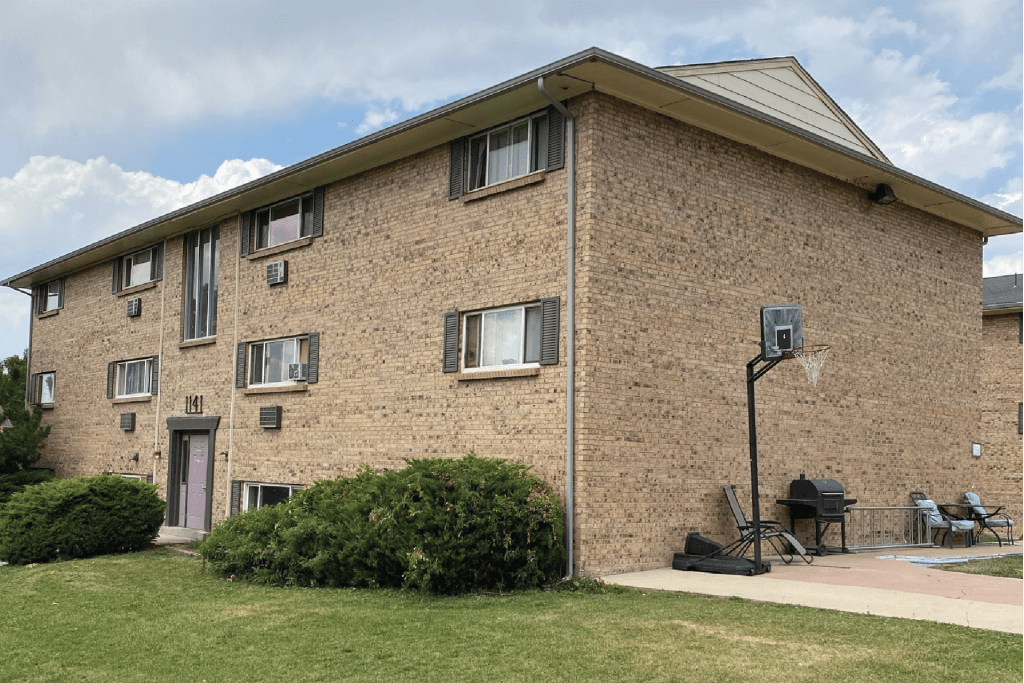

Before

After

Prosper advantage

In-House Property Management

Prosper Communities is a wholly owned subsidiary of Prosper that has turned and leased over 1,000 value-add units above pro forma since 2018. Prosper believes the best way to have its property management team aligned with the motivation of its investors is to have property management in-house. Most third-party property managers are motivated to grow their bottom line. In contrast, Prosper’s team is motivated to grow NOI and maximize each property’s potential.

Before

After

Prosper advantage

Construction Management

Prosper’s construction management team has over 30+ years of combined experience covering every trade needed to execute any multifamily and single-family remodel. Finding skilled labor continues to be the bottleneck in today’s construction industry. Prosper’s construction team are also fluent in Spanish which gives it a significant advantage in attracting, retaining and strengthening its relationships in the labor force. Prosper’s construction team also manages Prosper’s warehouse which stores all building and maintenance materials.

Before

After

Investing involves risk, including loss of principal. Past performance does not guarantee or indicate future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. While the data we use from third parties is believed to be reliable, we cannot ensure the accuracy or completeness of data provided by investors or other third parties. Neither Prosper Capital nor any of its affiliates provide tax advice and do not represent in any manner that the outcomes described herein will result in any particular tax consequence. Offers to sell, or solicitations of offers to buy, any security can only be made through official offering documents that contain important information about investment objectives, risks, fees and expenses. Prospective investors should consult with a tax or legal adviser before making any investment decision.